Cases in Japan

![]()

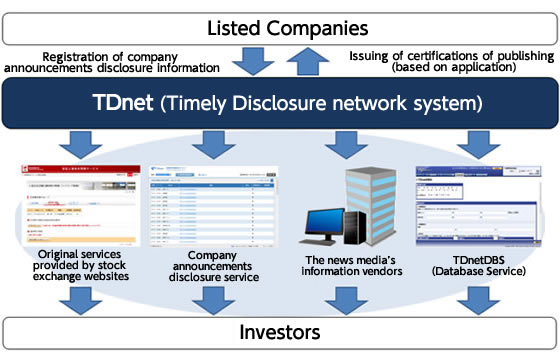

Tokyo Stock Exchange built TDnet (Timely disclosure network) for the purpose of transmitting corporate information extensively and rapidly. This system has been working from 1998. TDnet distributes listed companies' timely disclosure information to investors. Specifically, when each listed company registers its timely disclosure information, the system distributes the information to investors via stock exchange websites, Company Announcements Disclosure Service, and information vendors (see figure). Currently timely disclosure information from all listed companies, including the listed companies of Tokyo Stock Exchange, Nagoya Stock Exchange, Fukuoka Stock Exchange, Sapporo Securities Exchange and Green Sheet in Japan Securities Dealers Association, is distributed through TDnet.

Tokyo Stock Exchange is the first organization in the world which put XBRL to practical use in 2003, based on the idea that XBRL will enhance accuracy and reliability of listed companies' timely disclosure information, and also highly improve convenience of investors. However, back then, account settlement information(*) registered in TDnet by listed companies were converted to CSV format prior to distribution.

TDnet started a full-scale introduction of XBRL in 2008, considering the state of XBRL adoption by EDINET managed by Financial Services Agency. After the introduction, the account settlement information which had originally been distributed to investors in CSV format was distributed in XBRL format. In addition, TDnet has been actively applying XBRL into information of non-financial areas, as we can see from their XBRL application to "A report about Corporate Governance". After that, movements to support IFRS in financial results began in 2011, followed by measures to introduce Inline XBRL from 2014.

The documents published through TDnet may be reviewed on the Company Announcements Disclosure Service provided by the website of the Tokyo Stock Exchange for a period of 31 days (including public holidays and weekends) starting from the date of publication. This website also provides information on account settlements for the past five years and on important business matters and incidents occurring during the past year.

* Account settlement information suitable for XBRL applications includes financial results summaries, earnings forecast summaries, and dividend forecasts, etc.

Chart: Overview of TDnet

![]()

![]()